First Quarter Revenue of $29.1 Million up 17% YoY

Exchange Service Revenue up 148% YoY

(All monetary figures are expressed in Canadian dollars unless otherwise stated)

TORONTO – May 9, 2025 – illumin Holdings Inc. (TSX: ILLM and OTCQB: ILLMF) (“illumin” or the “Company”), the advertising technology platform that enables you to win your next customer, today announced its financial results for the first quarter ended March 31, 2025.

First Quarter 2025 Highlights

- First quarter 2025 revenue rose 17% year-over-year to $29.1 million, driven by higher Exchange service revenue, partially offset by lower Managed service revenue.

- Self-service revenue was $8.4 million, up slightly compared with the year ago period and represented 29% of total revenue.

- The Company on-boarded 18 net new Self-service clients during the quarter, reflecting sales initiatives targeting higher-spend clients and positioning the Company for continued long-term Self service revenue growth.

- Managed service revenue was $8.7 million compared to $11.8 million in the prior year, primarily reflecting more cautious marketing spend related to geo-political and macro-economic uncertainty.

- Exchange service revenue increased by 148% from the prior year to $12.0 million, resulting from increased demand from new customers, an enhanced supplier network, and platform improvements.

- Gross margin was 45% compared to 47% for the same period in 2024, reflecting the change in mix to service lines with lower margins, such as Exchange service.

- Net revenue, or gross profit (revenue less media-related costs), was $13.1 million, up 13% compared with $11.6 million in the prior year period.

- Adjusted EBITDA loss was $0.4 million, compared to $0.0 million in the prior year period, primarily attributable to higher operating costs due to higher sales, sales support functions, and marketing costs, partly offset by higher revenue.

- Net loss was $(1.9) million, compared to $(1.1) million in Q1 2024. The increase in the net loss was primarily a result of higher operating costs due to increased sales and marketing costs and a lower net foreign exchange gain compared to the prior year period, partially offset by higher revenue.

- On December 23, 2024, the Company commenced a new normal course issuer bid (“2024 NCIB”) for its common shares that will remain open until December 22, 2025, or such earlier time as the 2024 NCIB is completed or terminated at the option of the Company. Under the 2024 NCIB, the Company may purchase for cancellation up to 3,914,167 common shares, representing approximately 10% of the Company’s public float as of December 10, 2024. Daily purchases are limited to 12,518 common shares. For the three months ended March 31, 2025, the company purchased nil common shares pursuant to the 2024 NCIB.

Simon Cairns, illumin’s Chief Executive Officer, commented, “Our first quarter revenue rose 17% even after a slower start to the period than we anticipated. We responded by adjusting our marketing tests week to week and made several advances in our selling process and sales team, which enabled us to exit the quarter with solid growth, led by a 148% rise in our Exchange service revenue and supported by solid performance in Self-service.”

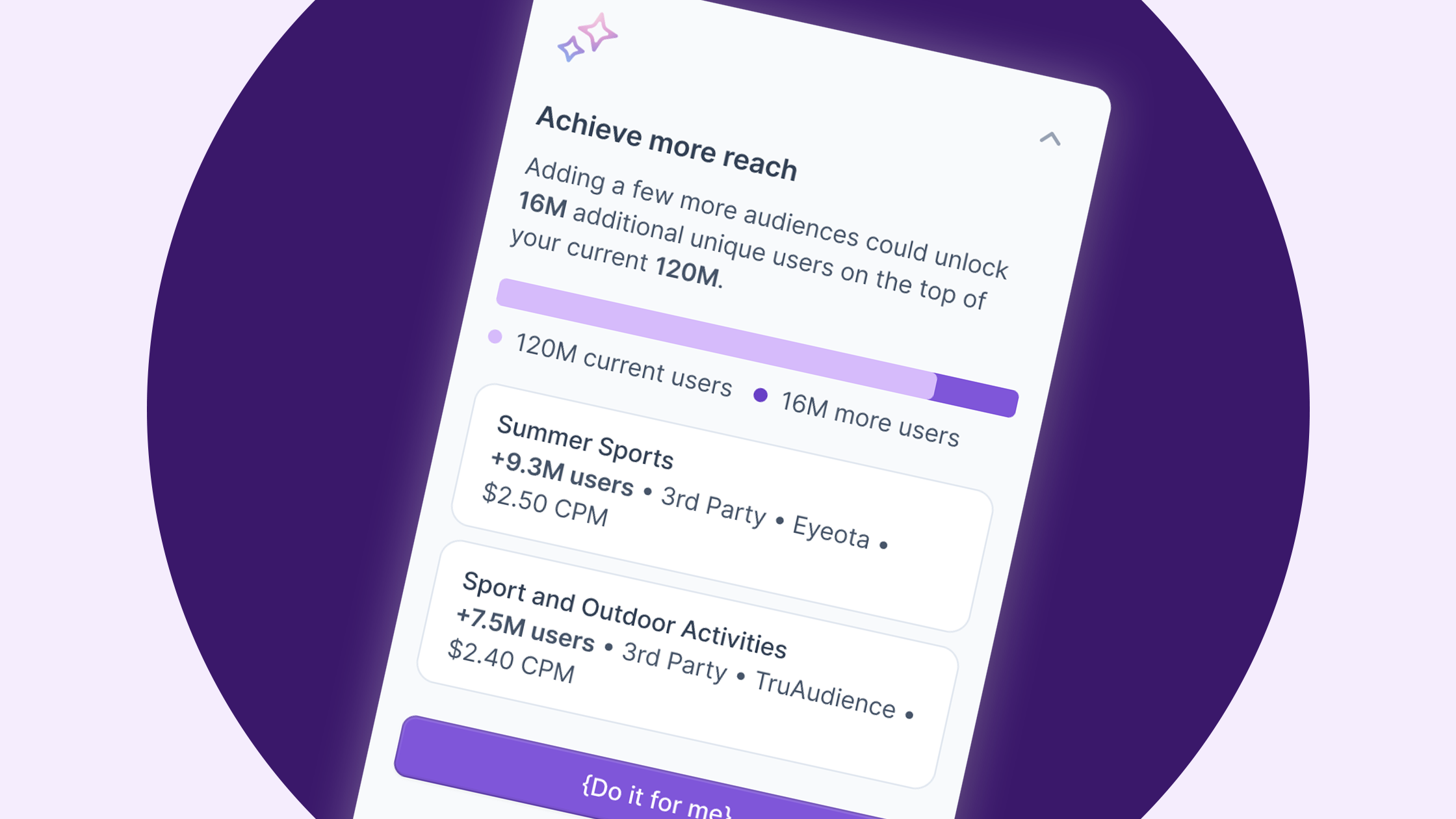

“In Exchange service, we continue to create and capture both new and recurring demand at surprising levels, as a result of product and selling investments that have given us some differentiation in a very crowded market. As for Self-service, we successfully added 18 new customers in the quarter, which is in line with our key goal of adding targeted, higher-spend clients in this growth area. Self-service revenue, while up slightly year-over-year, exhibited several solid underlying trends, such as increased customer adoption, spend performance and conversion.”

“We continue to employ the more customer-centric portfolio platform approach that we launched in the second half of 2024, where customers can pick and choose how they want to be supported. Our efforts to market and sell more effectively continue to yield initial positive results, assisted by our ability to offer our clients a broad range of solutions that fit their needs. We continue to invest in our Self-service platform and Exchange service offering, while balancing this with a focus on maintaining liquidity and cost management across our organization.”

“We remain focused on our plan – being aggressive in generating better marketing and sales performance, removing friction from our selling processes and furthering our product stickiness as a Self-first platform supported by complimentary Managed and Exchange services,” concluded Mr. Cairns.

Elliot Muchnik, illumin’s Chief Financial Officer, commented, “For what is typically a seasonally slower quarter, our strong year-over-year increase in total revenue reflects exceptional growth in Exchange service due to our initiatives to drive increased demand in this area. Adjusted EBITDA declined slightly despite higher revenues as we continued to make strategic investments in sales and marketing to bolster our long-term growth. As we look ahead, operational discipline continues to be a priority as we aim to grow our Adjusted EBITDA while preserving our substantial net cash position.”

The following table presents a reconciliation of Net loss to Adjusted EBITDA for the periods ended:

| Three months ended | ||||

| March 31, | March 31, | |||

| 2025 | 2024 | |||

| Net loss for the period | $ (1,854) | $(1,138) | ||

| Adjustments: | ||||

| Finance income, net | (337) | (506) | ||

| Foreign exchange gain | (311) | (1,386) | ||

| Depreciation and amortization | 1,382 | 1,365 | ||

| Income tax expense (benefit) | (63) | 378 | ||

| Share-based compensation | 737 | 699 | ||

| Severance expenses | 34 | 90 | ||

| Nasdaq-related costs1 | – | 423 | ||

| Other non-recurring expenses | 1 | 89 | ||

| Total adjustments | 1,443 | 1,152 | ||

| Adjusted EBITDA | $ (411) | $ 14 | ||

- Nasdaq-related costs are listing fees and directors’ and officers’ insurance specific to the Company’s Nasdaq listing and have been reclassed below Adjusted EBITDA as they are not recurring.

Conference Call Details:

Date: Friday, May 9, 2025

Time: 8:30AM Eastern Time

To register for the conference call webcast and presentation, please visit:

https://events.illumin.com/q1-2025-earnings-call

Please connect 15 minutes prior to the conference call to ensure time for any software download that may be needed to hear the webcast.

A recording of the conference call webcast will be available after the call by visiting the Company’s website at https://illumin.com/investor-information/