Advertising for tax preparation and financial services doesn’t have to be a daunting task. Here are some tips on marketing your tax-related and financial services.

It’s tax season once again – and for those of you who haven’t filed your taxes yet, time is ticking!

Just a quick reminder: the general U.S. filing deadline for 2025 is April 15th for most U.S. citizens residing inside the country while citizens of Canada have until April 30th to file their income tax and benefit return. (Please check with your local revenue agency for more information on your respective tax filing deadlines).

You may have gotten those emails from various tax preparation services reminding you of the deadline or enticing you to file your return with them. Maybe you’ve passed by one of those financial services and have noticed them heavily promoting their business this time of the year.

You may wonder why the sudden uptick in the promotion of these services during the tax season (besides the obvious) and how these businesses put their names in the forefront of your social feeds. However, if you’re one of those financial services or tax preparation businesses that are looking to take advantage of marketing your brand during tax season, then you’re in luck!

We’ve compiled some tips and tricks on advertising and marketing your tax and financial services to ensure that you also maximize your return on your ad spend and marketing dollars (See what we did there?).

Timing is everything

While it is good to heavily advertise during tax filing season, it is not enough if you want to stand out.

Consider putting out your promotional content even before tax filing opens. Curate content that would give tax filers a heads up about when tax filing can start (let’s say a month before or weeks leading up to when tax filing opens) as well as reminders (can be weekly or a few days before the deadline) for those who still haven’t filed their taxes yet.

It doesn’t have to end once tax filing ends as well. You can still continue to be at the top of mind for customers if you give them content that would resonate with them from time to time.

Organize webinars and information sessions that can talk about various topics of interest for customers (such as tutorials on filing taxes for the first time or perhaps, information sessions on government programs or benefits that citizens can look into that would get them a bigger return).

Be contextually relevant

Besides the timing, take advantage of the relevancy as well whenever you put out your marketing content. An example would be informing users whenever there are any announcements about tax law changes and how they may affect them.

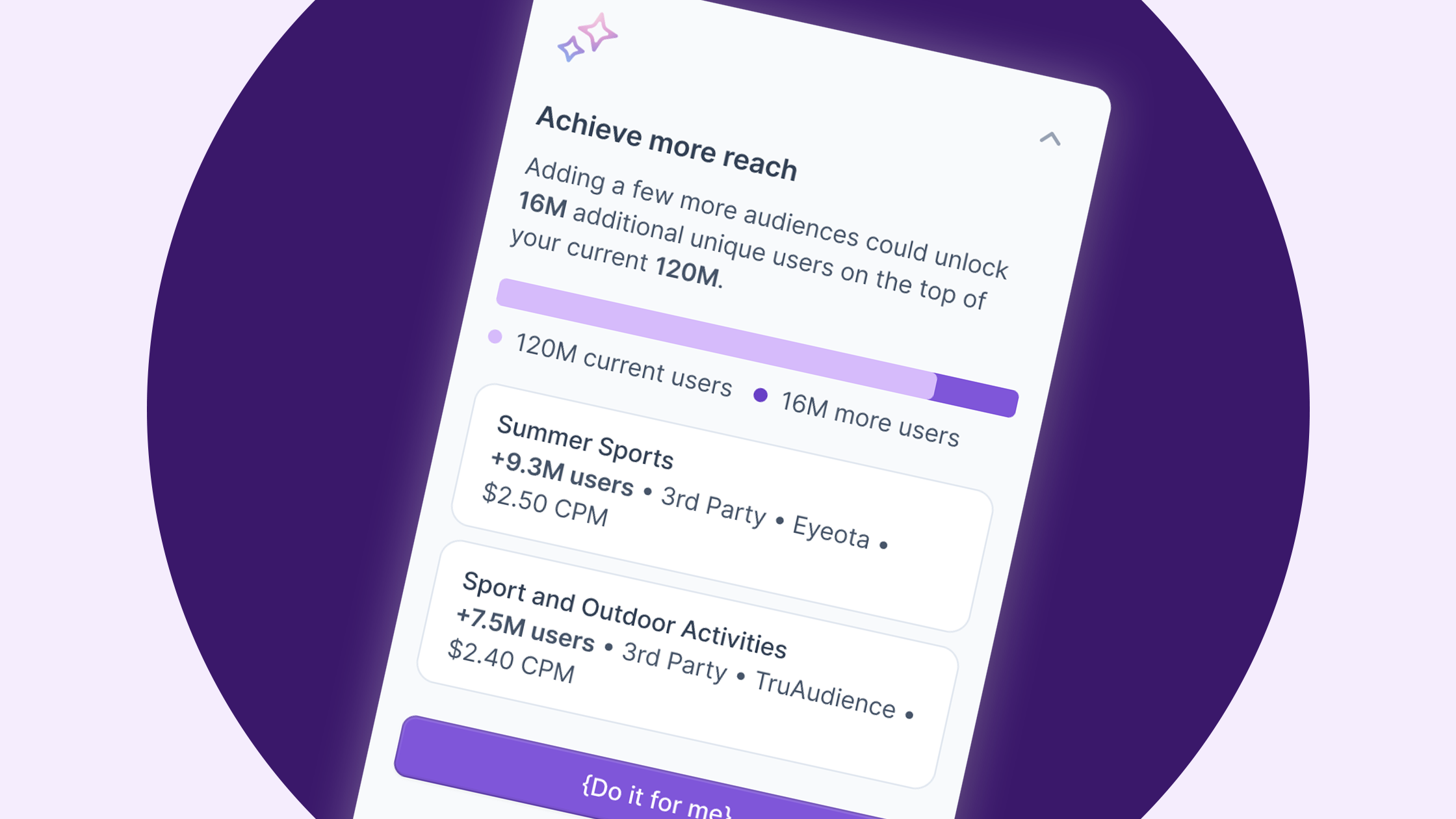

Consider also doing contextual targeting when you are promoting digitally. Contextual targeting is an advertising technique that involves placing ads on websites based on the content displayed on those web pages.

If users are searching for content that could be directly or indirectly relevant to your business, it may be wise to consider displaying ads that would be contextually relevant to them.

For example, if somebody searches for steps on how to secure a business loan for the first time, you can display ads to them if you’re a bank that specializes in offering grants and loans to small businesses at low interest rates.

Another example would be optimizing your website so that you’re also one of the top searches in similar categories to your own (such as targeting those who are looking into purchasing real estate properties if you’re a home insurance company).

Make your presence known online and offline

Nowadays, most people don’t want the hassle of filing their paperwork in person and would have the ease of filing them digitally. Take advantage of using social media to promote your business, whether it be on Meta, Instagram, TikTok, and more. Make use of email and SMS marketing as well to better reach and engage with your customers.

It’s not just enough to let your presence be known digitally. Consider also advertising through offline means as well as various other channels. We’re not just talking about your traditional print media – we’re talking about everything. From CTV advertising to out-of-home advertising, advertising through a wide range of platforms can lead to a longer recall and higher engagement amongst consumers.

Use short and sweet messaging

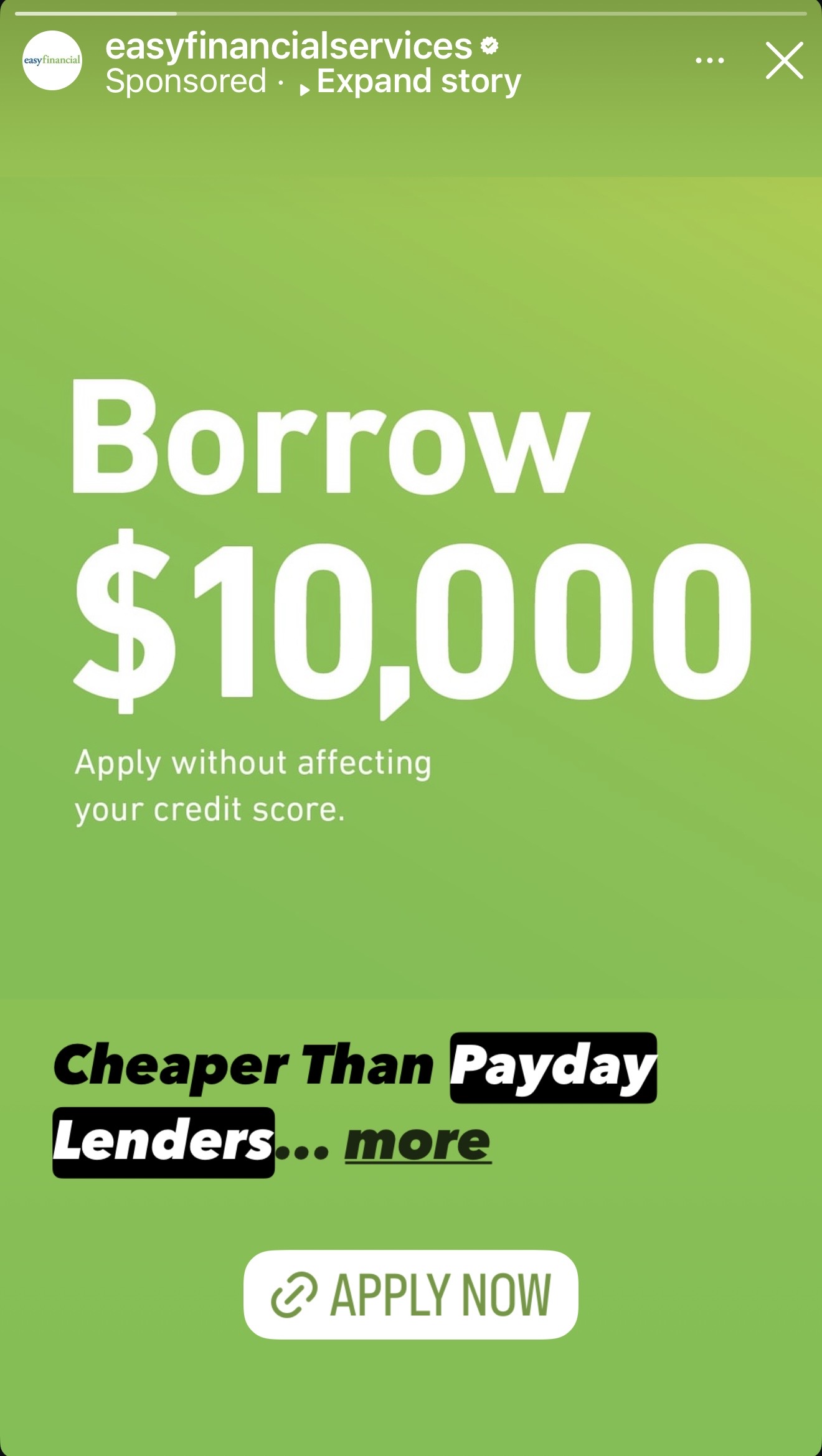

It can often be intimidating and overwhelming for some to file their taxes or partake in any huge financial transaction (especially for those doing it for the first time).

That said, make your messaging concise and easy to understand. Break down the steps for filing your taxes and use simple language. Make use of imagery and visuals so that your ads are eye-catching and easily digested by viewers (such as a clear, bold headline, graphics and colors that pop and stand out). Emphasize benefits and what you can do for your customers instead of just promoting what features you have. It makes it more relevant and useful for them to hear that instead of it feeling like a sales pitch to them.

Know your audience and be personal

It’s also wise to look into who your audiences are – knowing your customers and your ideal customer profiles so that you can better understand their needs, their behaviors, and shopping trends, their demographics, and more.

Think about whether they are first-time tax filers or home buyers who are securing a mortgage or loan for the first time. Look into whether your clients consume more content and news virtually or if they are still filing their taxes the traditional way. Ask yourself if your ads and content are actually accessible to your customers if you put them at a certain place over another.

Take for example, H&R Block when they partnered with Roblox in order to bring an immersive, tax-themed experience to the platform and make tax concepts easily digestible and understandable for the current generation who may not be as familiar with filing taxes or are just filing their tax returns for the first time.

Knowing who your audience is and where they interact gives you more insights on how to better target your ads and promote your services to them. It also makes it more personal for them if you provide them with content that personally resonates with them and addresses their personal needs (as we mentioned earlier).

Final thoughts

Most financial institutions miss the chance to market tax-related and financial services, leaving a large opening for businesses to stand out. A strategic and timely campaign could lead to substantial engagement and improved customer relationships not just during the tax season but throughout the year.

To see more from illumin, be sure to follow us on X and LinkedIn where we share interesting news and insights from the worlds of ad tech and advertising.